Author: Jason Burton

Deciding to purchase a new build property can be an exciting, but complex process. Below is a list of things to consider before you make an informed decision to purchase a newbuild, or if you are purchasing a property where there is a newbuild property at the top of the chain;

Deciding to purchase a new build property can be an exciting, but complex process. Below is a list of things to consider before you make an informed decision to purchase a newbuild, or if you are purchasing a property where there is a newbuild property at the top of the chain;

Developer Reputation

- Research the developer’s track record: Look at previous developments and reviews.

- Check for complaints or legal issues.

Warranty and Guarantees

- Most new builds come with a 10-year warranty (e.g., NHBC, LABC, Premier). You will need to ensure that the warranty provided is acceptable to your mortgage lender, and that the warranty protects your deposit between exchange and completion if the developer was to become insolvent.

- Confirm what’s covered under warranty (structure vs. fittings).

- Check the 2-year developer warranty for defects (within the first two years).

Price and Incentives

- Don’t assume it’s a good deal because it’s new — compare with similar resale properties.

- Developers often offer incentives: Stamp Duty contributions, furniture packs, or upgrades and many other variations.

- Some developers offer part-exchange on your current property.

- Are you a first time buyer? Look into First Homes Scheme launched in 2021 to help local first-time buyers and Key Workers.

- Ask if the price is negotiable, especially if the development is nearing completion.

- You will need to ensure that any price incentives are acceptable to your lender as your lawyer will need to obtain a UK Finance Disclosure of Incentives form from the developer and report this to your lender.

Build Quality and Snagging

- Inspect thoroughly during handover – consider hiring a professional snagging surveyor.

- Snagging issues could include poor finishing, faulty fixtures, or structural concerns.

- · Ask how the developer handles defects and snagging reports.

- · Understand their process and timescales for fixing issues post-move-in.

Completion Timeline

- Is the property ready to move in, or off-plan? If the property is not yet build complete, then it is likely that the developer will require you to exchange with a completion date on notice. The developers lawyer will then serve notice to complete once the property is complete and signed off by building control. If you have a property to sell, then you will need to consider whether this will be accepted by your buyer and any below chain, or if you would need to vacate your sale property to allow for the rest of the chain to complete with a fixed completion date.

- For off-plan, ask for estimated completion dates and any history of delays.

- Ensure that the purchase contract includes a longstop date – if the property is not complete within a certain period (usually 6 months from the estimated build date), then you would be entitled to rescind the contract if you considered that to be the best course of action. If there are other properties below in the chain, then their contract conditions would need to mirror the newbuild contract in this regard.

Management and Service Charges

- Some new developments are subject to an estate service charge.

- Understand how this is set up. Some estates service charges are created by a rent charge which is not acceptable to most mortgage lenders.

- Understand what’s included (e.g., communal gardens, lighting, maintenance).

- Get a full breakdown of service charges and how they may increase over time. You should be provided with a service charge budget for the current year.

- Ask who the management company who it is managed by. Sometimes a managing agent is employed to manage the communal areas. This will result in additional management charges.

- Some developments require that each plot owner will become a member of the management company and, if required, you will need to be prepared to become a director of the management company. You should consider whether you are prepared to take on this additional responsibility.

Energy Efficiency and Specs

- New builds are usually more energy-efficient — check EPC rating. If the property is not yet build complete, then it is a requirement that the property will have a Predicted Energy Assessment (PEA). If this the case, then the EPC should be provided once the property is build complete.

- Verify insulation, heating systems, solar panels, and window glazing.

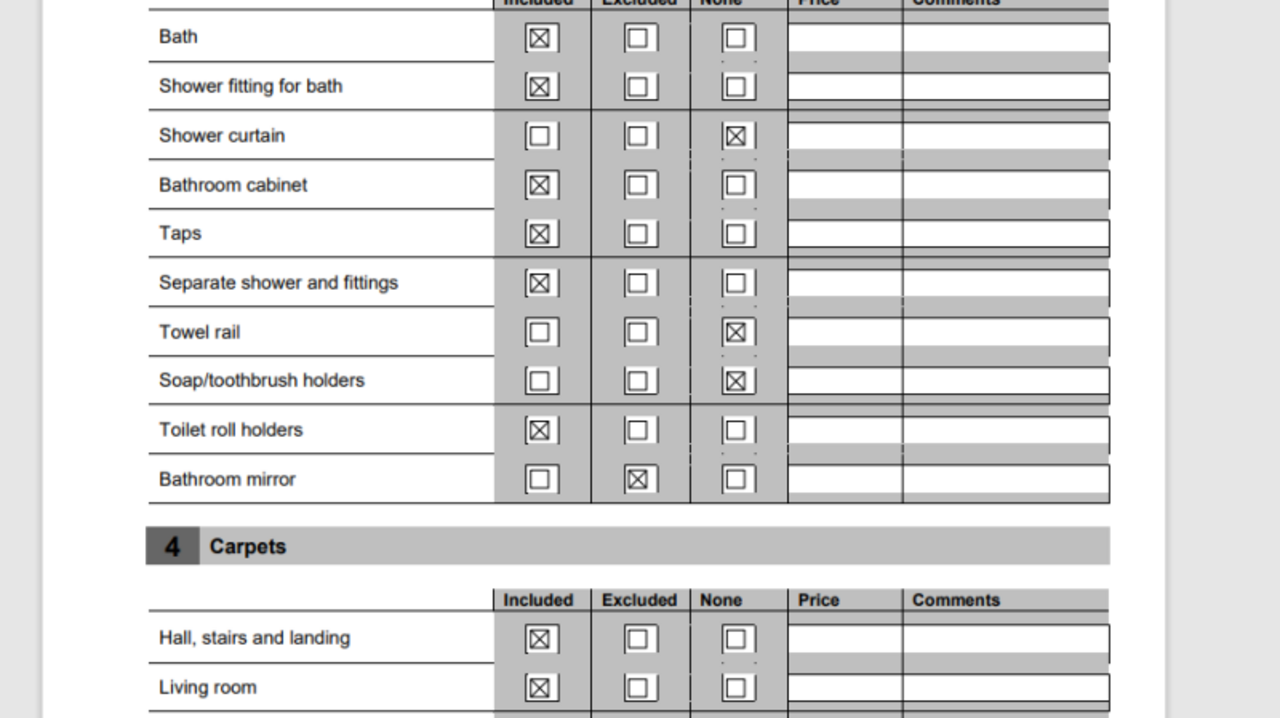

- Review what’s included in the base price vs. paid upgrades.

Mortgage Considerations

- Is the new build warranty provided by the developer acceptable?

- Is the management company/service charge acceptable?

- Will your mortgage offer expire before the long stop date?

- Are the incentives offered by the developer acceptable?

- Consider the status of roads and sewer adoption and whether this is acceptable.

Legal Representation

- Use a solicitor experienced in new builds – consider whether the one recommended by the developer would be the best option (potential conflict of interest).

- Ensure all planning permissions, warranties, and rights of way are in order.

Please note this article is provided for general information purposes only to clients and friends of Hayward Moon Limited. It is not intended to impart legal advice on any matter. Specialist advice should be taken in relation to specific circumstances. Whilst we endeavour to ensure that the information in this article is correct, no warranty, express or implied, is given as to its accuracy, and Hayward Moon Limited does not accept any liability for error or omission.